oklahoma franchise tax return form

Corporations not filing Form. Agency Code 695 Form Title.

Special Power Of Attorney Form Elegant Instruction To Fill Oklahoma Special Power Of Attorney Power Of Attorney Form Power Of Attorney Attorneys

Blank Forms Pdf Forms Printable Forms Fillable Forms.

. Oklahoma Tax Commission with each report submitted. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A Revised 7-2008 Requirement for Filing Return. Oklahoma MinimumMaximum Franchise Tax Return A. Over 50 Milllion Tax Returns Filed.

Franchise Tax Return Form 200. 200 Oklahoma Annual Franchise Tax Return. Ad We Support All Common Tax Forms and Most Less-Used Forms.

Franchise Tax Return Form 200. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. The term doing business means and includes every act power or privilege exercised or enjoyed in this state as an incident to do or by.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512. Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at.

Complete Edit or Print Tax Forms Instantly. Complete Edit or Print Tax Forms Instantly. 0 Federal 1499 State.

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. Mine the amount of franchise tax due. Corporations that remitted the maximum.

To make this election file Form 200-F. IReturn Oklahoma Annual Franchise Tax Return Revised 8-2017 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in this return and any. Once completed you can sign your fillable form or send for signing.

Download Oklahoma Annual Franchise Tax Return 200 Tax Commission Oklahoma form. Corporations that remitted the maximum. Oklahoma Franchise Tax Form.

2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 259 minutes to complete The 2021 Form 512. Oklahoma Annual Franchise Tax Return State of. Ad Oklahoma Franchise Tax Form.

Who qualifies to File. Browse By State Alabama AL Alaska AK Arizona AZ. No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered.

Use Tax - Individual. The term doing business. Online Federal Tax Forms.

Download or print the 2021 Oklahoma Form 512 Corporate Income Tax Return form and schedules for FREE from the Oklahoma Tax Commission. CARS - Online Renewal. Please put your FEIN on your check.

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Ad Get A Jumpstart On Your Taxes.

Import Your Tax Forms And File For Your Max Refund Today. All forms are printable and downloadable. To make this election file Form 200-F.

Easily Download Print Forms From. To make this election file Form 200-F. Due Date-Office Use Only- FC.

Oklahoma Tax Reform Options Guide Tax Foundation

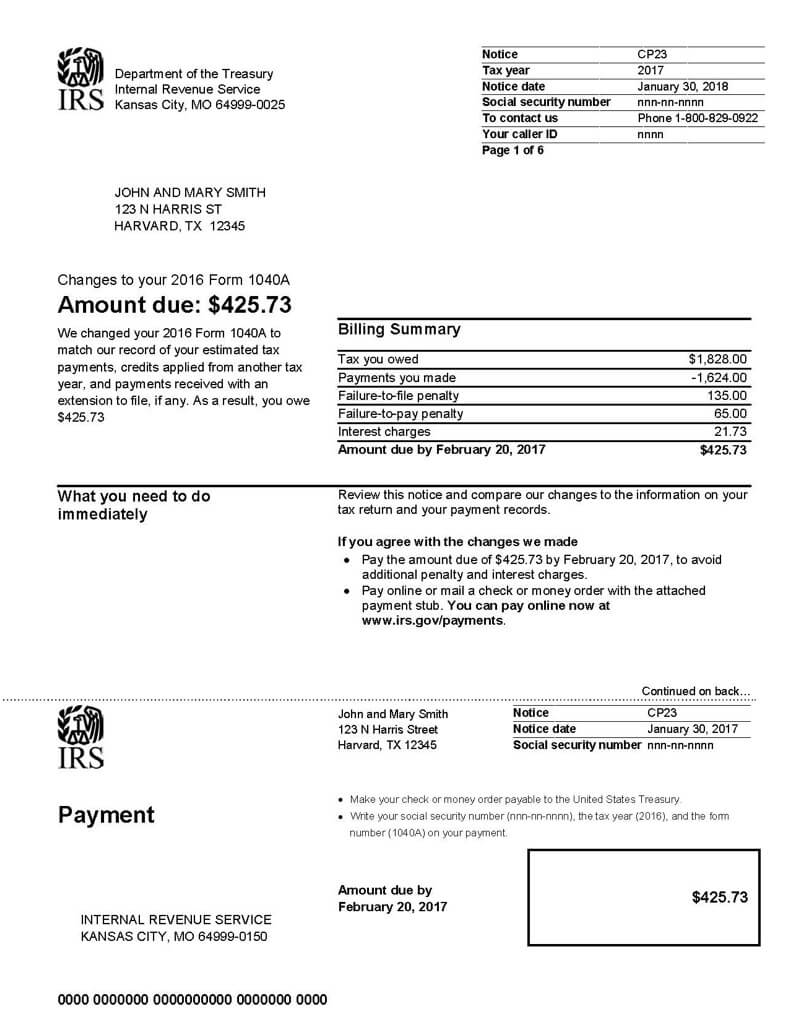

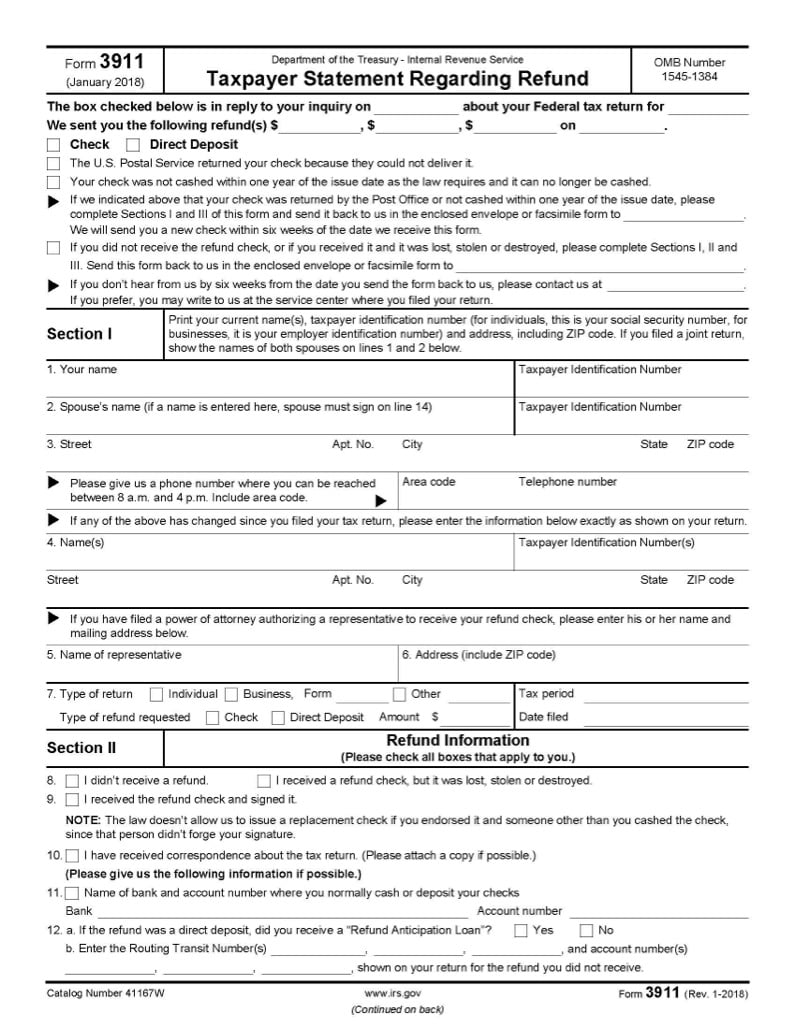

Form 3911 Never Received Tax Refund Or Economic Impact Payment Jackson Hewitt

Form 3911 Never Received Tax Refund Or Economic Impact Payment Jackson Hewitt

Stimulus Checks The States Releasing New Payments For May 2022 Marca

Form 3911 Never Received Tax Refund Or Economic Impact Payment Jackson Hewitt